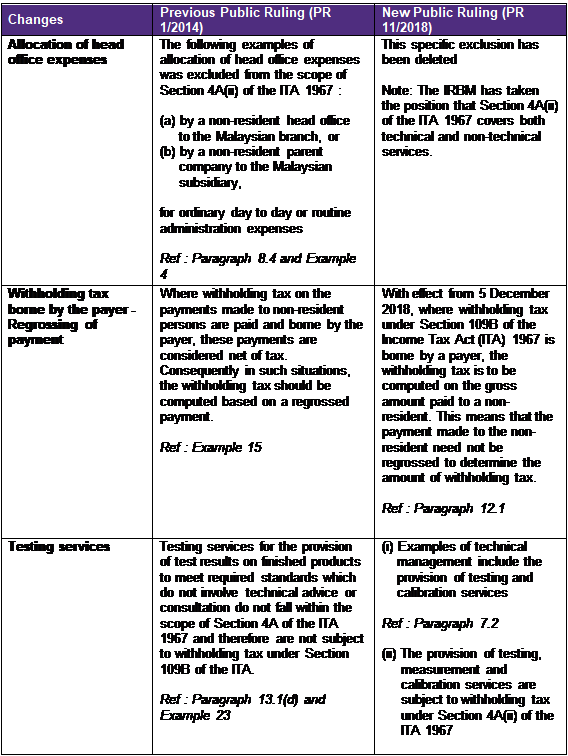

112018 on 5 December 2018 which supersedes the previous guidance on nonresident withholding tax on special classes of income PR No. Malaysia Issues Public Ruling on Withholding Tax on Special Classes of Income.

112018 which explains the special classes of income that are chargeable to tax under section 4A of the Income Tax Act 1967 ITA and related withholding rules.

. 112018 which explains the special classes of income that are chargeable to tax under section 4A of the Income Tax Act 1967 ITA and related withholding rules. A the income of a non-resident person who is chargeable to tax under paragraph. 12010 Date of Issue.

Deloitte refers to one or more of Deloitte Touche Tohmatsu Limited DTTL its global network of member firms. Percentage of the payment must be withheld and paid to the Collector of Income Tax CIT. 12014 Withholding Tax on Special Classes of Income last amended on.

12014 on Withholding Tax on Special Classes of Income on 23 January 2014. 5 December 2018 Page 1 of 39 1. Payments made to non-residents in respect of the provision of any advice assistance or services performed in Malaysia and rental of movable properties are subject to a 10 WHT unless exempted under statutory provisions for purpose of granting incentives.

Sponsor of the NR public entertainer is required to pay withholding tax of 15 before an entry permit for the NR public entertainer can be obtained from the Immigration Department. Objective The objective of this Public Ruling PR is to explain the - a special classes of income that are chargeable to tax under section 4A of the Income Tax Act 1967 ITA. Special classes of income that are chargeable to tax under Section 4A of the Income Tax Act 1967 ITA.

INLAND REVENUE BOARD OF MALAYSIA WITHHOLDING TAX ON INCOME OF A NON-RESIDENT PUBLIC ENTERTAINER Public Ruling No. A Public Ruling as provided for under section 138A of the Income Tax Act 1967 is issued for the purpose of providing guidance for the public and officers of the Inland Revenue Board of Malaysia. The Inland Revenue Board IRB of Malaysia issued Public Ruling PR No.

62017 Date Of Publication. 5 December 2018 Page 1 of 39 1. 12 October 2017 Page 4 of 19 entertainer.

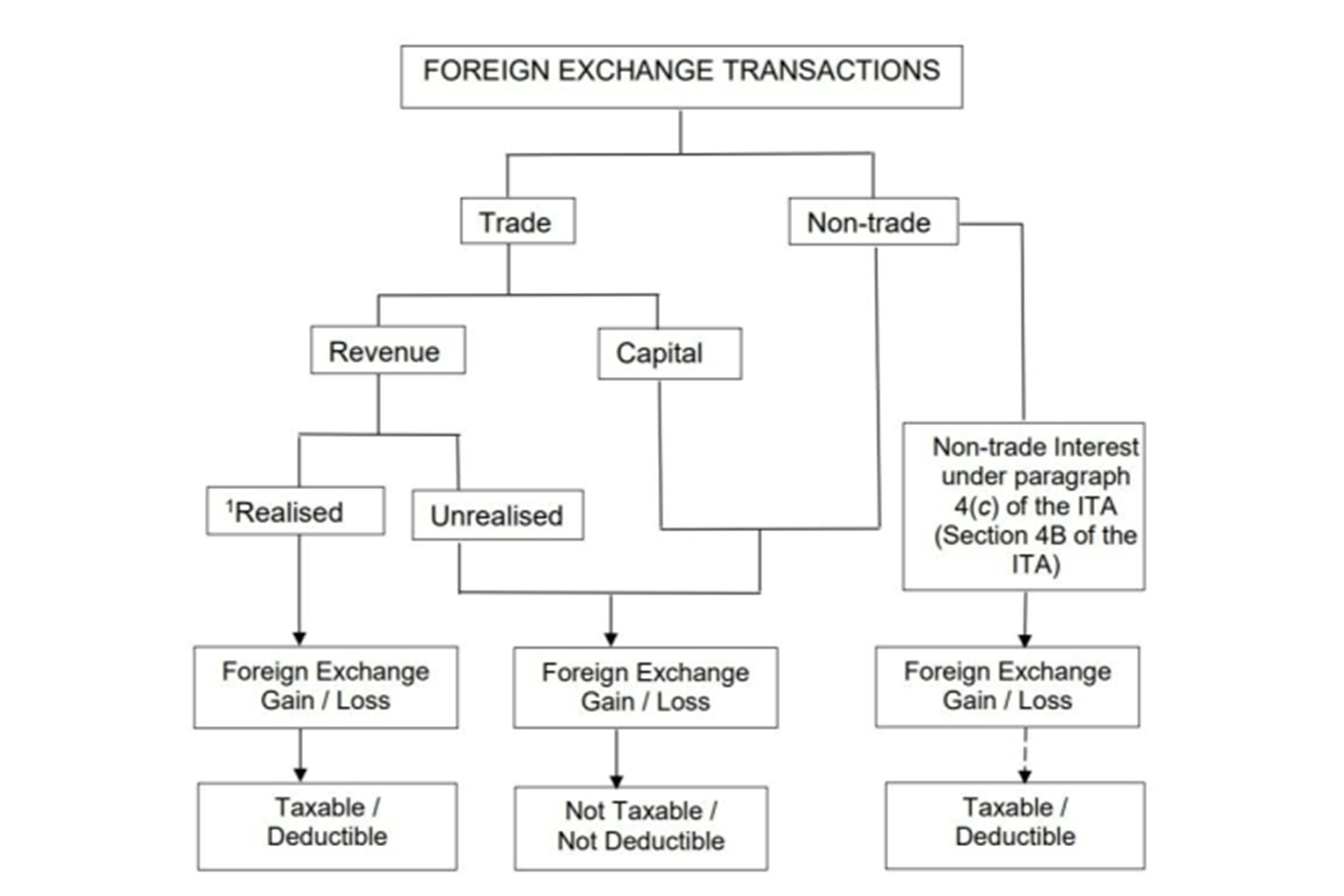

The special classes of income covered by the public ruling include amounts paid in consideration of services. See Terms of Use for more information. Effective from 1st January 2008 scope of witholding tax have been expanded to include.

12014 last amended on 27 June 2018. Sources shown in the preceding table. 42005 and its addendums.

Malaysia Issues Public Ruling on Withholding Tax on Special Classes of Income The Inland Revenue Board of Malaysia IRBM has issued Public Ruling PR No. The Inland Revenue Board of Malaysia IRBM issued Public Ruling No. 102019 Withholding Tax on Special Classes of Income dated 10 December 2019 to explain the.

The Inland Revenue Board of Malaysia IRBM has issued Public Ruling PR No. 42 Initially witholding of tax was provided on loan interest paid to non-residents only. A 10 withholding tax rate is imposed on special classes of income that are chargeable to tax under section 4A of the Income Tax Act.

The percentage amount withheld is witholding of tax. PR 112018 reflects changes to the tax law made via the Finance Act 2017 and other guidance Practice. Remuneration or other income in respect of services performed or rendered in Malaysia by a NR public entertainer is subject to withholding tax of 15 on the gross payment.

Objective The objective of this Public Ruling PR is to explain the - a special classes of income that are chargeable to tax under section 4A of the Income Tax Act 1967 ITA. Remuneration or other income in respect of services performed or rendered in Malaysia by a Non-resident public entertainer is subject to withholding tax at 15 on the gross payment. 5 December 2018 Page 1 of 39 1.

112018 Withholding Tax on Special Classes of Income PR 112018 The Inland Revenue Board of Malaysia IRBM has uploaded on its website the PR 112018 issued on 5 December 2018 which supersedes the previous Public Ruling No. WITHHOLDING TAX ON INCOME UNDER PARAGRAPH 4f INLAND REVENUE BOARD MALAYSIA Public Ruling No. DIRECTOR GENERALS PUBLIC RULING.

19 April 2010 Issue. The fee s paid to both the cellist and compere are subject to withholding tax as provided in section 109A of the ITA. A Page 1 of 14 1.

Tax on Special Classes of Income Public Ruling No. The Inland Revenue Board of Malaysia issued Public Ruling No. 12014 on Withholding Tax on Special Classes of Income on 23 January 2014.

WITHHOLDING TAX ON SPECIAL CLASSES OF INCOME Public Ruling No. 12014 was issued to replace PR No. New Public Ruling on Withholding Tax on Special Classes of Income.

WITHHOLDING TAX ON SPECIAL CLASSES OF INCOME Public Ruling No112018 INLAND REVENUE BOARD OF MALAYSIA Date of Publication. Objective The objective of this Public Ruling PR is to explain the - a special classes of income that are chargeable to tax under section 4A of the Income Tax Act 1967 ITA. Public Ruling PR No.

WITHHOLDING TAX ON SPECIAL CLASSES OF INCOME Public Ruling No112018 INLAND REVENUE BOARD OF MALAYSIA Date of Publication. WITHHOLDING TAX ON SPECIAL CLASSES OF INCOME Public Ruling No112018 INLAND REVENUE BOARD OF MALAYSIA Date of Publication. 102019 Withholding Tax on Special Classes of Income Introduction The Inland Revenue Board of Malaysia IRBM has recently released PR No.

This Ruling provides clarification on.

Payments That Are Subject To Withholding Tax Wt

Withholding Tax On Special Classes Of Income Chartered Tax

St Partners Plt Chartered Accountants Malaysia Lhdn Latest Public Ruling Public Ruling No 10 2019 Withholding Tax On Special Classes Of Income The Objective Of This Public Ruling Is To

Tax Alert Grant Thornton Malaysia

Inland Revenue Board Of Malaysia Pdf Free Download

Newsletter 27 2017 Wht On Income Of A Non Resident Public Entertainer Page 002 Jpg

St Partners Plt Chartered Accountants Malaysia Lhdn Public Ruling No 11 2018 Withholding Tax On Special Classes Of Income The Objective Of This Public Ruling Is To Explain The A Special

Five Public Rulings Updated And One New Public Ruling Issued By The Inland Revenue Board Ey Malaysia

Inland Revenue Board Of Malaysia Pdf Free Download

Newsletter 27 2017 Wht On Income Of A Non Resident Public Entertainer Page 001 Jpg

Inland Revenue Board Of Malaysia Qualifying Expenditure And Computation Of Capital Allowances Public Ruling No 6 Pdf Free Download

Enewsletter 06 2020 Rsm Malaysia

.jpg)

Financing And Leases Tax Treatment Acca Global

.png)

.png)